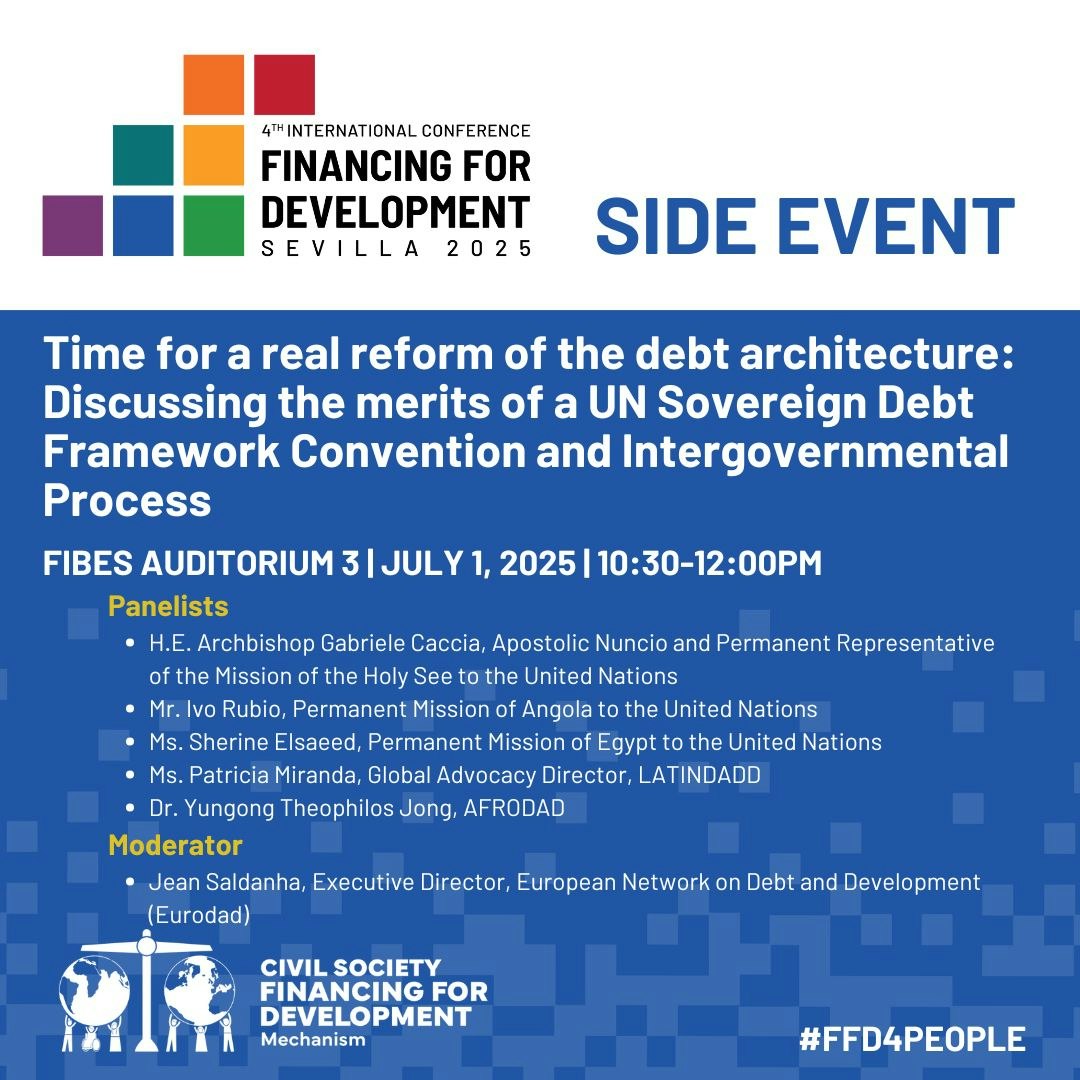

Time for a real reform of the Debt Architecture: the case for the UN Debt Framework Convention and an Intergovernmental Process on Sovereign Debt

AUDITORIUM 3 | TUESDAY 1 JULY | 10:30AM - 12:00PM

Abstract

The world is struggling with a debt of at least USD 315 trillion with at least 30% of the total debt owed by developing economies. The Global South is struggling with a debt crisis that is the consequence of structural imbalances and an unfair economic system that has failed to work for the majority. The existing international financial architecture completely fails at preventing debt crises as well as at offering fair, timely and comprehensive solutions when countries face debt distress. The proposal of a United Nations Framework Convention on Sovereign debt is paramount since it acts as a catalyst in promoting a financial architecture that works for development and facilitates affordable and long-term financing, at the same time as offering an inclusive fora to discuss debt workouts, thereby allowing countries to focus on development needs rather than on short-term debt constraints.

Description

In the late 1990s and mid-2000s, most Global South countries including African countries benefited from the debt restructuring process of the Highly Indebted Poor Countries Initiatives of 1996 (HIPC) and Multilateral Debt Relief Initiatives of 2005 (MDRI) to help return to sustainable debt levels. However, the debt relief, in many cases insufficient and conditioned to harmful neoliberal conditionalities, was not coupled by the much needed structural reforms in order to avoid a new debt crisis. Keeping the same system means today the world is ill equipped to deal with an even more complex crisis.

Global south countries are facing record high debt payments, risking any advancement on SDGs and becoming an obstacle for climate action, gender and social equality. Debt relief is urgent, but it must be accompanied by reforms to offer solutions now and in the future. Countries in need for debt write-offs face chaotic debt restructurings that take too long and offer too little debt relief. Creditors rule in all of the forums that decide on sovereign debt matters.

The session will discuss which reforms need to be advanced at the FfD4 Conference and how a UN framework convention on sovereign debt can be instrumental to discuss and decide on those reforms in a democratic and inclusive manner. Different stakeholders, including CSOs, academics and representatives of country groups and Member States will discuss the possibilities of agreeing on an intergovernmental process in Sevilla that can deliver on the debt convention, as well as on the very much needed multilateral sovereign debt resolution mechanism.