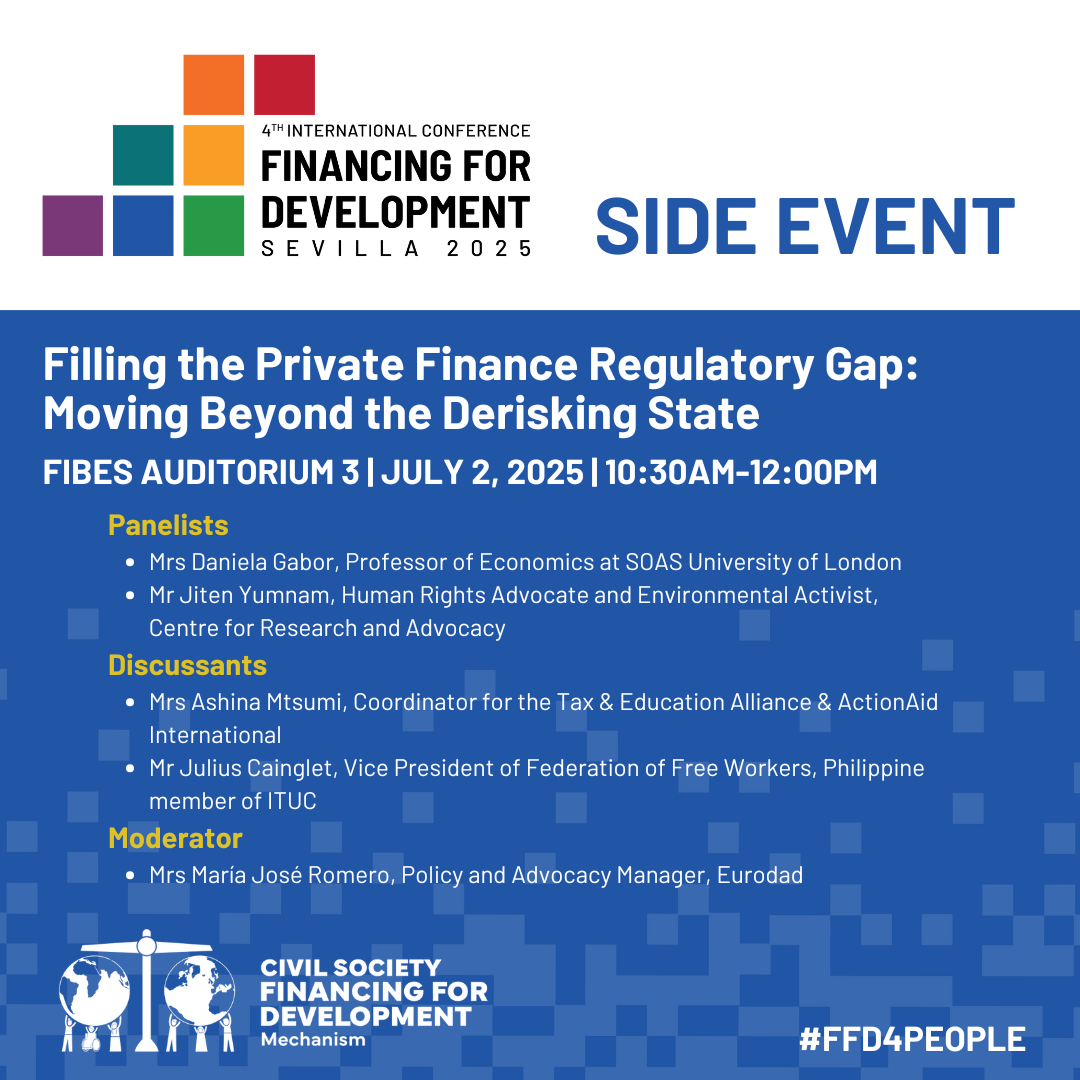

Filling the Private Finance Regulatory Gap: Moving Beyond the Derisking State

AUDITORIUM 3 | WEDNESDAY 2 JULY | 10:30AM - 12:00PM

Abstract

Creating the enabling business environment to attract private investments has been increasingly presented as a panacea to fill a so-called financing gap to deliver on the SDGs. While the spirit of the FfD process was about dealing with the systemic barriers that hamper Global South countries’ capacities to mobilize resources to sustain their own development paths, FfD discussions and proposals now showcase major reliance on private finance and business to deliver on the Agenda 2030. Through de-risking and regulating with a focus on bankable investment opportunities for private actors, States delegate obligations and offer profits to actors that are not necessarily aligned with public interests and national development priorities. This side event will offer a more nuanced perspective on the role of the private sector in development, including the importance of an international enabling environment for development and the regulatory role of the State.

Description

Over the years, the global development agenda has become increasingly focused on creating an enabling environment to attract private (foreign) investors, using scarce public resources to leverage private investments to fill a so-called financing gap to deliver on the Sustainable Development Goals (SDGs). This agenda - known as ‘from billions to trillions’ - has translated into different initiatives and the proliferation of various financing mechanisms. These include the Global Investors for Sustainable Development (GISD) Alliance, a group of leaders of major financial institutions and corporations (including commercial banks, asset managers and insurance companies) from across the world convened by the United Nations Secretary-General to scale up private finance, and the promotion of blended finance, public private partnerships (PPPs), guarantees and different types of bonds.

According to a private finance-first development approach, States’ actions should aim at removing ‘regulatory barriers’ and de-risking investments in order to incentivise private actors that expect to maximise returns on their investment. This approach, however, has turned out to be a ‘fantasy’; inadequate to deliver sustainable development outcomes, to protect peoples’ right to basic services and the environment. Even more, it undermines the important and potentially transformative (and developmental) regulatory role of the State, which in response to nationally-owned development strategies can promote socio-economic transformation of countries in the Global South.

This event will discuss the pitfalls of an overreliance on self-regulated private actors, including greenwashing, SDG-washing and risks related to blended finance and other so-called innovative finance instruments. It will also draw attention to public policy options available for states to regulate the role of the private sector in development, including the financial sector and the asset management industry, and the kind of systemic reforms needed to achieve socio-economic transformation. Discussions will draw from the FfD4 negotiations and outcome document, and will provide an alternative view to the one offered in the (official) International Business Forum.